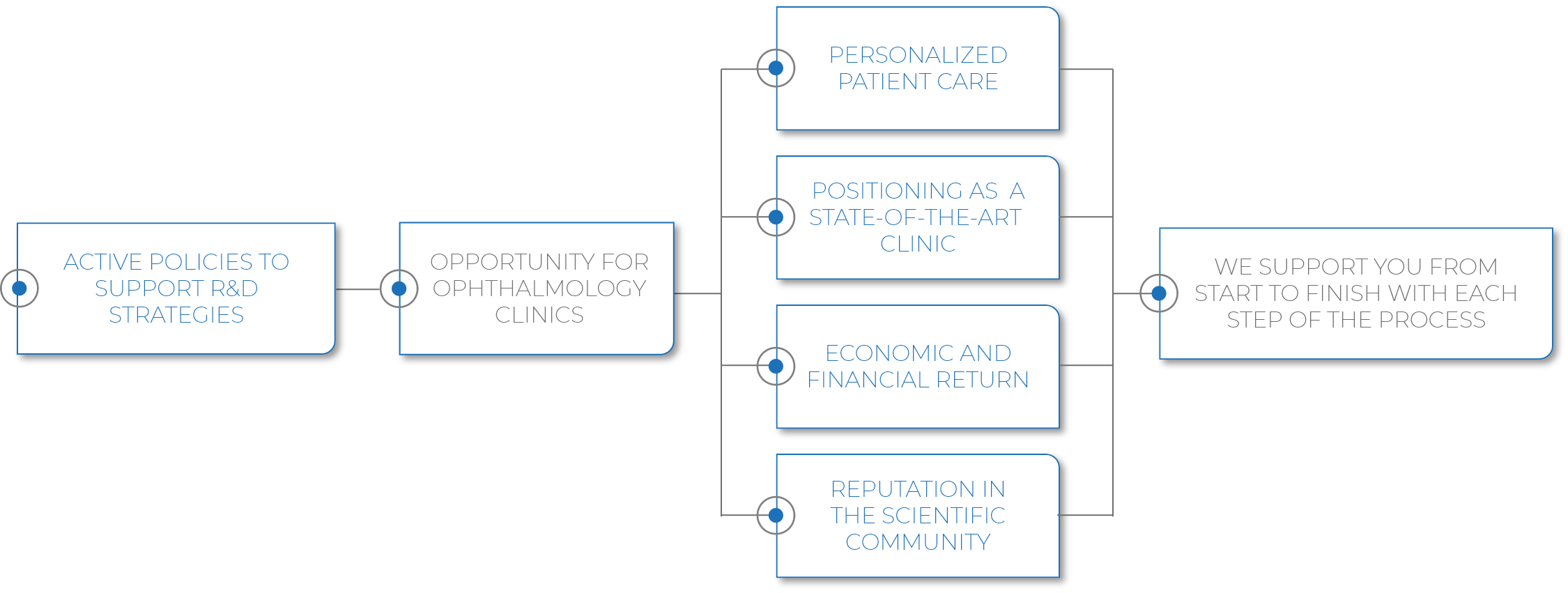

Government of Spain supports research and development initiatives

In Spain, the Tax Agency defines a regulatory framework to promote research.

We help you to develop the projects and to present them together with all the required documentation to obtain these deductions for the clinic.